How to Buy Air NZ Shares Online with 0% Commission

Air New Zealand is a global airline that delivers journeys to more than 17 million customers each year who fly to, from, and within New Zealand. The company is based in Auckland and operates flights to 20 domestic and 32 international destinations in 20 countries. It is also publicly listed on the New Zealand Stock Exchange (NZX), meaning that you can buy Air New Zealand shares through a licensed share broker.

In this guide, we explain how to buy Air NZ shares online in New Zealand. We also provide a step-by-step walkthrough of how you can buy shares and recommend top brokers in New Zealand.

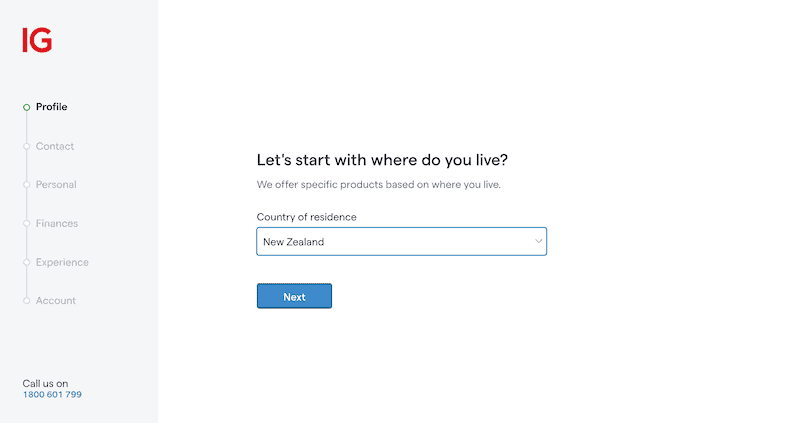

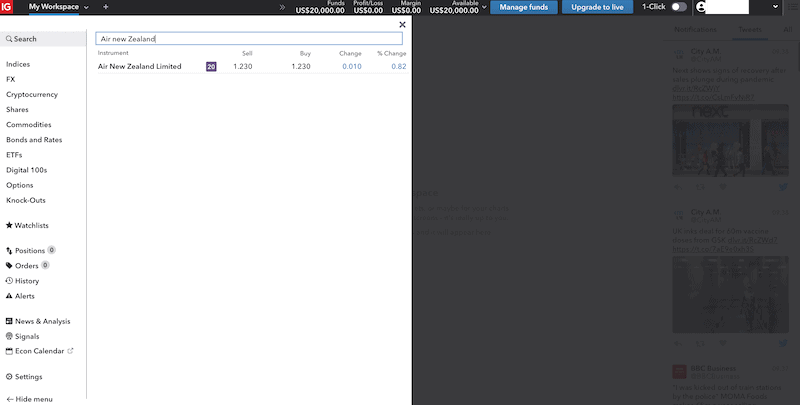

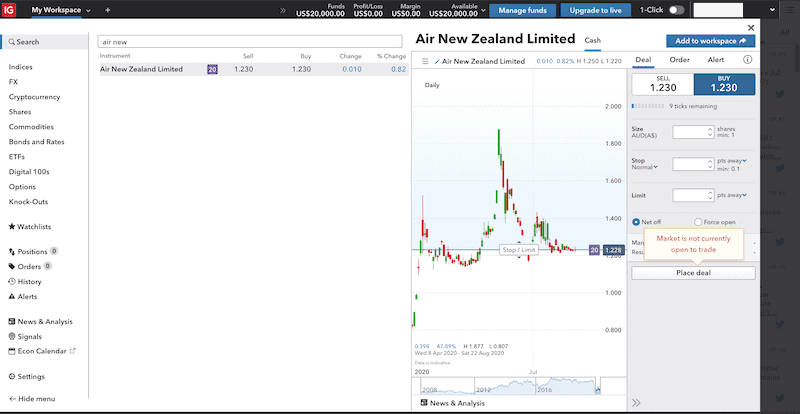

With that said, you need to make sure you choose a broker that is regulated and authorized to operate in New Zealand. To help you find the right share broker, below we have reviewed some popular NZ share brokers that allow you to buy Air NZ shares online. IG is also one of the few online share brokers that offers to buy Air NZ shares. This CFD broker allows you to trade shares with leverage of 20:1 if you are a New Zealand retail trader and 25:1 for professional traders. Even though IG Markets doesn’t offer commission-free trades, you will get competitive fees of just NZ$7, and 0.09% commission per side. We should also note that IG offers a range of market insights, trading tools, and trading platforms, so it’s a good choice for beginners and experts alike. With this broker, you can choose to trade on the desktop platform, on your web browser or the mobile app. Further, it offers a wide range of trading platforms that include the IG’s proprietary trading platform, the MetaTrader4, the ProRealTime, and the L2 Dealer. You will be able to open an account by depositing NZD$480 or the equivalent in different currencies if you deposit via credit/debit card. However, there’s no minimum deposit requirement if you’re funding your account via bank transfer or PayPal. Pros: Cons: Your capital is at risk. In order to determine whether you should buy Air New Zealand shares, it’s important to do your own background research about this company and the airline industry, particularly as the COVID-19 crisis increases the risk of buying airline shares. Below, we’ll cover all the crucial information you need to know in order to decide if it’s the right time to buy New Zealand shares. Air New Zealand Limited was founded in 1940 as TEAL (Tasman Empire Airways Limited), a private airline company operating flights between New Zealand and Australia. In 1965, it became governmentally owned but was privatized again in 1989. In the same year, Air New Zealand went public (24 Oct 1989) and since 1993, it was trading at a narrow range between $0.42-$18.53. Finally, the company returned to partial government ownership in 2001 after near bankruptcy of the New Zealand airline. At the time of writing in July 2020, shares of Air New Zealand are trading at $1.32 per share after a drop of more than 50% due to the COVID-19 pandemic that had a direct impact on the global travel industry. With that being said, a share price drop often makes a company more attractive to long-term potential investors. Air New Zealand has a market capitalization of NZ$1.48b, which means that many large institutions own shares in the company. On top of that, the New Zealand Government actually owns 52% of Air New Zealand ordinary shares and the remaining shares are owned by institutions and the public. As a matter of fact, the company has a safety net should anything go wrong, and evidently, in March 2020 the New Zealand Government has stepped in to protect the airline with a significant financial deal that allows the company to keep operating. Since its foundation, Air New Zealand has been a favorite share for dividend investors. Generally, the carrier pays an annual dividend of NZD$0.32 per share, which means it pays out 88.98% of its total earnings out as a dividend. For the past decade, the company paid an annual dividend yield of 9.7%, much higher than the industry average. Having said that, it is important to note that the company is not allowed to pay dividends to shareholders while government loan is used. As mentioned previously, Air New Zealand was getting a $900 million loan in March for a 24-month. As such, below we list the reasons why investors remain bullish on Air New Zealand shares. According to analysts, the company appears to be undervalued to where the share price trades currently. This is likely to result from the COVID-19 crisis that often extremely disrupts share prices. The Air NZ share price plummeted from $3.05 in January 2020, to just 0.80p on March 23. Since then, however, the share bounced back to trade at around $1.30. At the moment, nobody knows when the pandemic will end and it’s hard to tell when tourism picks up again. While some airline carriers may not survive the COVID-19 crisis, it appears that Air New Zealand is in a good position and is already planning for the reset and recovery phases ahead. Air New Zealand isn’t just the favorite airline carrier in New Zealand, it’s also very popular worldwide. The company has enjoyed a monopoly on New Zealand to the North American route and practically, any route on the Pacific ocean. A growing market like New Zealand with one dominant player would normally be expected to attract more competitors, but so far, Air New Zealand is the most prestigious airline in its home country and the competition is relatively low. Air New Zealand has recently received ongoing liquidity through a $900 million government loan package. This comes as no surprise as the New Zealand Government owns 52% of Air New Zealand ordinary shares. Government support is not a guarantee for the success of the carrier, however, it provides a safety net in case of an emergency or an economic crisis. Now that you have enough information about Air NZ shares, you can move on to the next step of opening a trading account. We’ll walk you through the process using our recommended broker IG Markets, which offers a safe trading environment, low trading fees, and access to New Zealand shares. To get started, you need to visit IG Markets’ homepage and click on the ‘Create Live Account’ button at the top right corner of the screen. You will then be asked to enter your personal information such as your full name, country of residence, contact details, trading experience, the account type, and then create a password. As IG Markets complies with regulatory requirements, you will also be asked to verify your identity. This means you will need to upload a copy of your: Once you have completed the registration process, you can fund your account. You will have to meet a minimum deposit requirement of around NZ$480 (AUD$450) if you decide to use a credit/debit card or any amount you wish if you choose to deposit funds via bank transfer or PayPal. Once your account is funded, you can then buy Air NZ shares. If opting for IG’s WebTrader platform, you need to navigate to ‘search’ and then enter Air New Zealand. Once you click on the result that pops up, you will immediately notice an order form and a chart. Then, click on the ‘Buy’ button to place a buying order in the market. On the order form, you then have to specify how much you wish to invest, and the type of order (market or limit). While a market order is an order to buy or sell shares immediately, a limit market order is an order to buy or sell the shares at a better price. You can also set a stop-loss order to limit your loss in case you’re on the wrong side of the trade. Note: If you are buying Air New Zealand shares outside of standard market hours (9:00 am – 4:45 pm GMT+12), you will need to click on ‘Place Deal’. Your Air NZ share purchase will then be completed when the markets open. On one hand, we are witnessing a crisis that is unique and unpredictable. Many leading airline carriers face severe economic losses over coronavirus refunds and the implications of the COVID 19 on tourism. However, Air New Zealand is the country’s national carrier and it is a necessity to keep this company operating due to New Zealand’s unique location on the planet. Consequently, the New Zealand government has agreed to bail out the only major airline in the nation with a $NZ900 million if it faces financial instability amid the COVID-19 pandemic. Ultimately, if you believe that Air New Zealand is trading at a discount price and will rise again to its pre-pandemic price levels, you can buy the shares at a considerably cheap price. There’s no doubt that any positive development in the aviation sector will have a strong impact on the share price of Air New Zealand. As such, if you do want to buy shares in Air New Zealand, we suggest using IG Markets.

There is no guarantee you will make money with this provider.

Air New Zealand is primarily listed on the New Zealand Stock Exchange under the ticker symbol NZE: AIR. In addition, this airline has a secondary listing on the Australian Stock Exchange under the ticker symbol ASX: AIZ.

Share dealing fees vary from broker to broker. If you decide to buy Air NZ shares using IG, you will pay a commission of NZ$7 as well as 0.09% per side.

Yes, Air New Zealand pays dividends twice a year. In fact, Air New Zealand offers a yearly net dividend yield of around %9.7 for the past 10 years.

Yes, CFDs on shares do pay dividends as long as you purchased the shares before the company's ex-date.

Well, when you use online brokers like IG Markets, you can buy fractional shares. This means you can basically buy a portion of an Air New Zealand share. While this may not beneficial in the case of Air New Zealand due to its low share price, you will be able to use this feature on other pricey shares such as Amazon, Tesla, and Google. Like many other sectors, the music industry has been significantly affected by COVID-19, with the massive cancelation of live events and huge ticket sales revenue drops amid the lockdown. With earnings from live music events shrunk to the lowest level in history, artists increasingly rely on income from streaming platforms. According to data presented by... Software solutions have entered all aspects of life in the digital age, with millions of individuals and businesses relying on operating systems and apps to carry out daily tasks. The entire sector’s growth has been followed by the increasing number of software startups searching for a way to raise capital and expand their growth. According... WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. BuyShares.co.uk © 2025. All Rights Reserved. UK Company No. 11705811.

Step 1: Find a Stock Broker That Offers Air NZ Shares

1. IG – Buy Air NZ Shares with Competitive Fees

Step 2: Research Air NZ Shares

Air NZ Share Price History

Air New Zealand Dividend Information

Should I Buy Air NZ Shares?

The Company is Trading at a Discount

Effective Control of the Aviation Sector in New Zealand

Government Financial Aid

Step 3: Open an Account and Deposit Funds

Step 4: Buy Air NZ Shares

The Verdict

IG – Buy Air NZ Shares With No Commission

FAQs

Is Air New Zealand only traded on the New Zealand Stock Exchange?

How much does it cost to buy Air NZ shares in New Zealand?

Does Air New Zealand pay dividends?

Can I collect dividends when trading CFDs?

What is the minimum number of Air NZ shares that I can buy?

Tom Chen

Latest News

Music Streaming Revenues to Hit $23B in 2021, a 50% Jump Compared to pre-COVID-19 Figures

Software Startups Raised $176.7B in Total Funding, a 27% Increase YoY