Best Stock Market App NZ 2025

If you’re looking to actively buy and sell shares online – you’ll likely want to obtain a stock market app, too. This will allow you to access the markets no matter where you are, subsequently allowing you to place trades at the click of a button.

Additionally, the best stock market apps in New Zealand allow you to set up pricing alerts and even receive relevant financial news stories direct to your phone.

In this guide, we discuss the best stock market apps currently available to New Zealand residents. We’ll also explore what factors you need to consider before downloading a stock market app – such as fees, commissions, tradable shares, regulation, and payments.

Your capital is at risk.

How to Choose the Best Stock Trading App for You

Although we have hand-picked a selection of the best stock market apps for you, it is still advisable for you to do your own research. This will ensure that your chosen trading app is 100% suited for your personal investment goals. Additionally, there might come a time when you’re tempted to use a new stock market app that we have previously critiqued.

Regulation

Your first port of call should be to check the regulatory standing of your chosen app. Don’t forget – all stock market apps are provided by traditional online brokers – so they must be in receipt of a license if they wish to accept NZ traders. All five of the apps that we have discussed on this page hold at least one license from a tier-one body. This includes the likes of the FCA, ASIC, and CySEC. Ultimately, if you come across a stock market app that isn’t regulated by a reputable body – avoid it.

Stock Assets

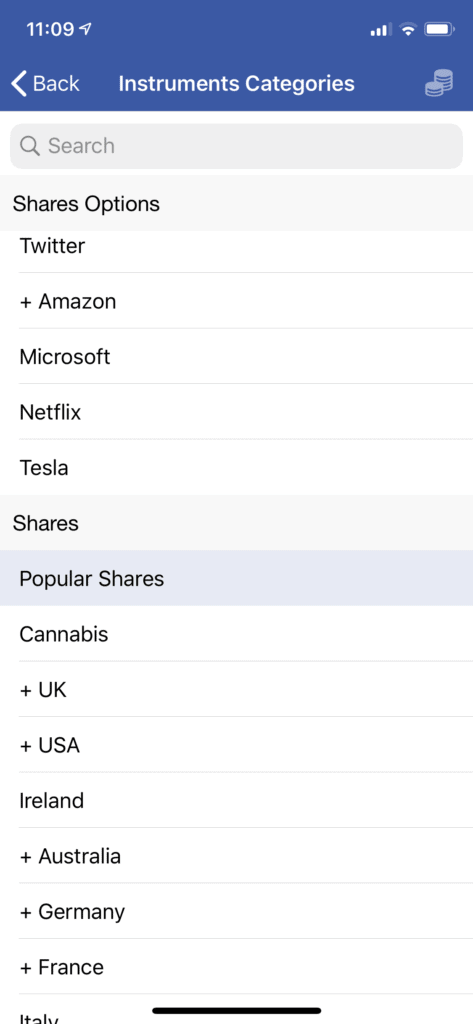

You then need to explore the app to see what stocks it gives you access to. For example, if you are looking to invest in companies listed in the US or UK. Alternatively, if you want to trade companies listed on the New Zealand Exchange – Plus500 and IG are great options to consider.

Fees

It goes without saying that you need to have a firm understanding of what fees your chosen stock market app charges. At the forefront of this are commissions and spreads. The former is a fee that you will pay every time you buy, sell, or trade a stock.

Other than IG and Saxo Bank, all of the stock market apps that we have discussed on this page allow you to trade in a commission-free manner.

Additionally, you should also look at ad-hoc fees. For example, some stock market apps charge a deposit and/or withdrawals. You should also look at whether you will incur any FX charges and if the app has an inactivity fee policy in place.

Platform & Usability

Most investors in New Zealand will buy and sell shares on their standard desktop device – as this generally offers a better all-round trading experience. After all, stock market apps will need to be accessed on a much smaller screen size.

With that said – if and when you get around to using your chosen app to place orders – you’ll want the user experience to be as seamless as possible.

As a result, you’re better of sticking with apps that are easy and straightforward to use.

Trading Tools & Features

The best stock market apps in New Zealand give you access to a plethora of useful tools and features. Some of the most notable are listed below:

- Fractional Ownership: This allows you to buy a ‘fraction’ of a share. This is especially handy if you want to buy US stocks like Facebook, Apple, or Tesla that are priced in the hundreds of dollars.

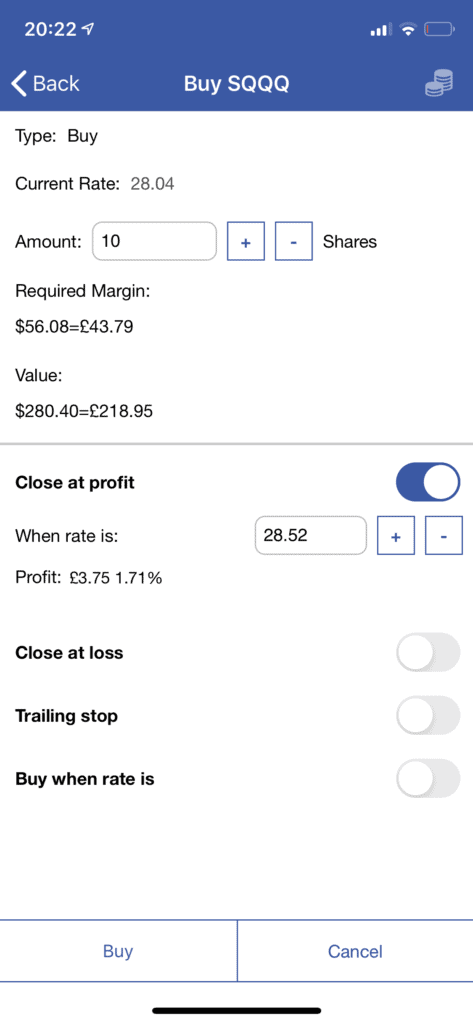

- Leverage: All of the stock market apps listed on this page allow you to trade with leverage. For those of you with a higher appetite for risk, Plus500 offers leverage of up to 1:30.

- Pricing Alerts: Pricing alerts will notify you when your chosen stock hits a specific price. For example, if you might want to trade Facebook shares the very minute it hits $500.

- Copy Trading: This feature allows you to copy an expert trader. Each and every position they place will be mirrored in your personal portfolio.

As always, you can check what features and tools the stock market app will offer before you open an account.

Device Compatibility

Most stock market apps are designed for both Android and iOS phones – as collectively, these operating systems dominate 99%+ of the smartphone space. However, there might be a slight disparity in available tools and features depending on the operating system.

For example, the IG app on Android comes with all account features, while the iOS version does not permit deposits or withdrawals. As such, make sure that your chosen stock market app is fully compatible with your respective operating system.

Demo Account

It’s always a good idea to stick with providers that offer a demo account facility. The best stock trading apps usually give you a pre-loaded ‘paper’ balance that allows you to trade stocks in a 100% risk-free manner. Not only does this allow you to build your trading knowledge – but also get to grips with the app in question.

Similarly, seasoned traders like stock apps that come with demo account facilities because it allows them to test out new ideas and strategies.

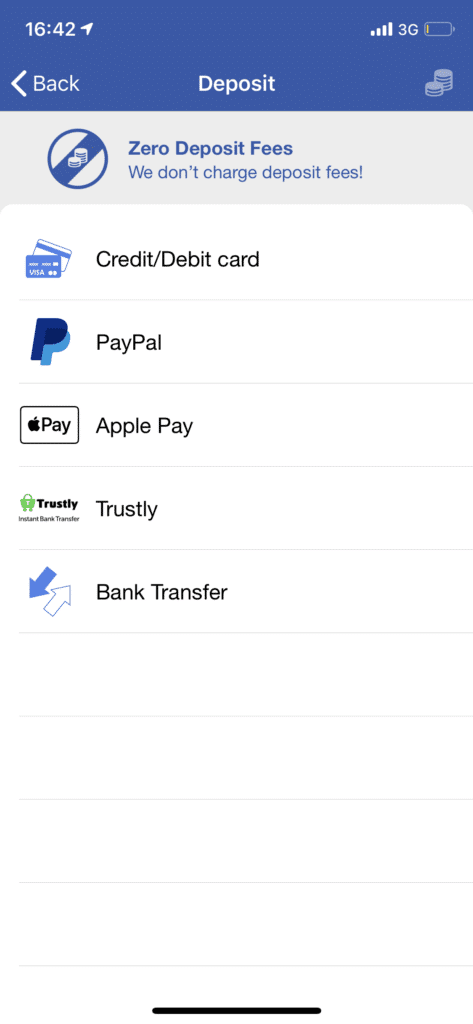

Payments

For those of you who look to trade with real money, you will need to ensure that the app supports your chosen payment method. In New Zealand, the best stock market apps for Android and the best stock apps for iPhone support local debit/credit cards and e-wallets. This will allow you to deposit funds instantly and usually – fee-free.

The vast majority of top stock market apps also allow you to deposit funds via an NZ bank transfer. But, this can take 2-3 working days to clear. In addition to supported payment methods, you should also check what the app’s withdrawal policy is. For example, there might be a minimum amount that you can withdraw.

Customer Service

Although most traders in New Zealand are able to use stock trading apps without needing assistance – that won’t be the case for everyone. As such, you’ll want to access a top-notch customer support team. We find that the best stock market apps allow you to speak with a live support agent via live chat.

This ensures that you can resolve your query no matter where you are. Failing that, some stock market apps offer a telephone support line. At the other end of the spectrum, some apps only offer customer service via email or a support ticket. Irrespective of your trading skillset – you should probably avoid such apps.

The Verdict

By reading our guide on the best stock apps of 2020 – you should now have a clearer picture as to which provider is suited for your financial goals. We have also shown you the many factors that you need to look out for prior to making choosing the best stock trading app for you – such as those surrounding fees, regulation, and tradable shares.

FAQs

What is a stock market app?

A stock market app allows you to buy and sell shares via your mobile phone. The application will be backed by a regulated brokerage house that also offers trading via its main desktop website.

What are the best stock market apps for Android?

This depends on what your financial goals are. If you are looking to buy and sell shares in a simple and cost-effective manner. Alternatively, if you're looking to place more sophisticated stock trades with high levels of leverage - you might want to consider Plus500.

Are stock market apps safe?

Yes - stock market apps are safe - but this is on the proviso that the app is backed by a regulated broker. As we noted earlier, your chosen app should hold a tier-one license - such as those issued by ASIC more the FCA.

Can you trade real money on a stock market app?

Yes - you will be using a stock market app that is provided by an online brokerage house. As such, you will be trading with real money. You can typically fund your account with a debit/credit card, e-wallet, or bank wire.

What is the cheapest stock market app?

There are brokers that are generally perceived to be the most cost-effective stock market app in the space. This is because there are no monthly or annual fees, no sign up fees, and most importantly - no trading fees.

Latest News

Music Streaming Revenues to Hit $23B in 2021, a 50% Jump Compared to pre-COVID-19 Figures

Like many other sectors, the music industry has been significantly affected by COVID-19, with the massive cancelation of live events and huge ticket sales revenue drops amid the lockdown. With earnings from live music events shrunk to the lowest level in history, artists increasingly rely on income from streaming platforms. According to data presented by...

Software Startups Raised $176.7B in Total Funding, a 27% Increase YoY

Software solutions have entered all aspects of life in the digital age, with millions of individuals and businesses relying on operating systems and apps to carry out daily tasks. The entire sector’s growth has been followed by the increasing number of software startups searching for a way to raise capital and expand their growth. According...

If you’re based in New Zealand and already possess experience in stock trading – you might want to consider the Saxo Bank application. This Denmark-based broker is hugely popular with seasoned investors that you will have a range of advanced features and tools at your disposal.

If you’re based in New Zealand and already possess experience in stock trading – you might want to consider the Saxo Bank application. This Denmark-based broker is hugely popular with seasoned investors that you will have a range of advanced features and tools at your disposal.