How to Buy Fisher and Paykel Healthcare Shares Online in New Zealand

Fisher and Paykel Healthcare Corporation Limited is a New Zealand based company that develop, designs, manufactures, and distributes products and systems for use in respiratory care, acute care, and the treatment of obstructive sleep apnea. The company has grown into a global company operating in 50 countries and has a market capitalization of 20.415B as of July 2020. It is also one of the few companies that is thriving During the COVID-19 Pandemic.

In this guide, we show you how to buy Fisher and Paykel Healthcare shares online in New Zealand. We also uncover the best brokers in New Zealand to buy shares from and provide a step-by-step walkthrough on how to open a trading account and buy Fisher and Paykel shares.

Step 1: Find a Stock Broker That Offers Fisher and Paykel Healthcare Shares

Fisher and Paykel Healthcare Corporation Limited is a company operating in various locations across the globe, and has two primary listings – on the New Zealand Stock Exchange (FPH.NZ) and the Australian Stocks exchange ASX: FPH. Additionally, the company’s shares are listed on the Over the Counter OTC market (FSPKF).

Fisher and Paykel Healthcare Corporation Limited is a company operating in various locations across the globe, and has two primary listings – on the New Zealand Stock Exchange (FPH.NZ) and the Australian Stocks exchange ASX: FPH. Additionally, the company’s shares are listed on the Over the Counter OTC market (FSPKF).

This means you’ll have to find a share broker that not only gives you access to the New Zealand Stock Exchange but also regulated and authorized to offer financial services for New Zealanders. You will need also to take into consideration a range of factors before signing up with a stockbroker such as the fees and commission the broker charges, the leverage ratio, and trading platforms and tools it provides.

Taking all of this into account, below you will find some reputable brokers in New Zealand that allow you to buy and sell shares of Fisher and Paykel Healthcare Corporation Limited.

1. Plus500 – Low-Cost Share CFD Trading Platform

In terms of pricing, Plus500 does not charge any stock trading fees besides the buy/ sell price. It is also worth mentioning that spreads on Plus500’s platform are very competitive and below the average in the industry. This may be beneficial for active traders that want to reduce their trading fees.

The trading platform is user friendly and easy to use, particularly the mobile app. You will also get access to a range of risk management tools such as the guaranteed stop and trailing stop orders. These tools will help you to avoid slippage which is essentially the difference between the price of trade you placed in the market and the price at which the trade is executed.

You will be able to open an account by depositing NZ$200 with debit/credit cards, electronic wallets (PayPal or Skrill), or bank transfer. Plus500 is also heavily regulated, with licenses from the FCA in the UK and ASIC in Australia. The parent company of the broker, Plus500UK Ltd, is listed on the London Stock Exchange.

Pros:

- Offers thousands of financial instruments including shares of Fisher and Paykel Healthcare

- Competitive spreads and fees

- You can short-sell a stock CFD if you think its value will go down

- Leverage of up to 1:5 for share trades

- Accepts PayPal

- User-friendly trading platform

- Supports mobile app

Cons:

- More suitable for experienced traders

CFD Service. Your capital is at risk.

2. IG – Trusted Share Dealing Platform with Competitive Fees

Although IG cannot rival Plus500’s free-commission model, you will have access to more investment opportunities as well as a wider range of trading platforms. IG gives you access to four trading platforms, algorithmic trading, price alerts, market insights, and trading signals service.

When it comes to the safety of your funds, IG is heavily regulated by top regulators including the FSP under the license number 18923. It is also listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. If you wish to get started with IG, you will need to meet a minimum deposit requirement of around NZD$480 when depositing via debit/credit card.

Pros:

Cons:

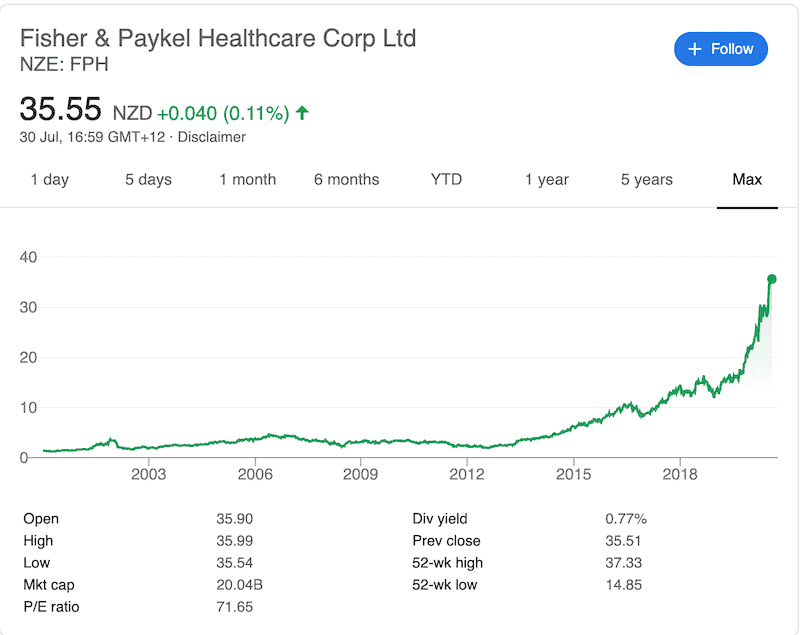

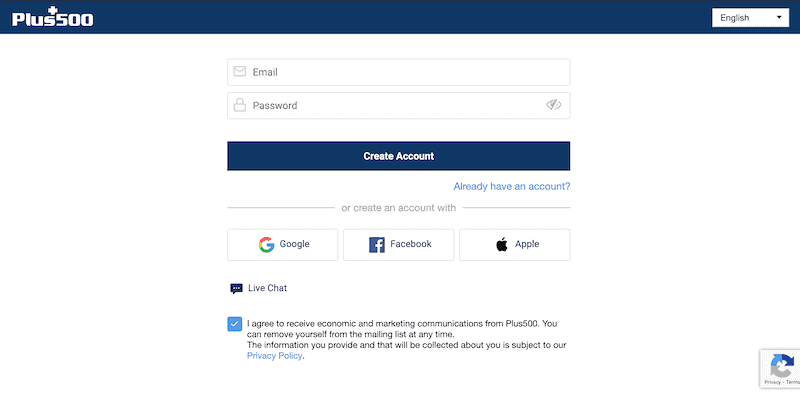

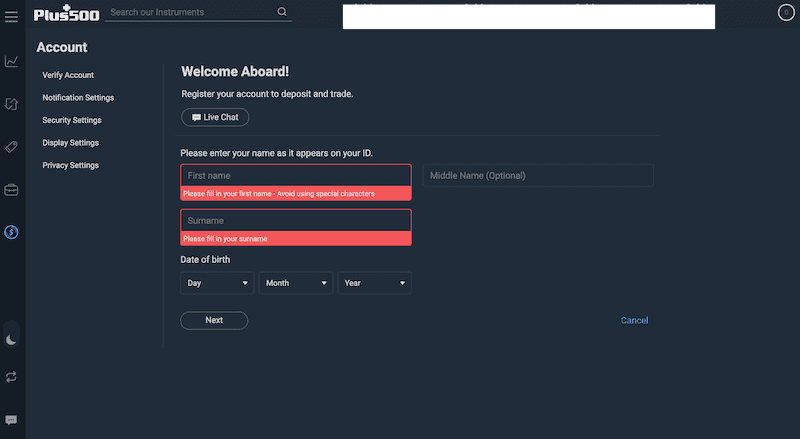

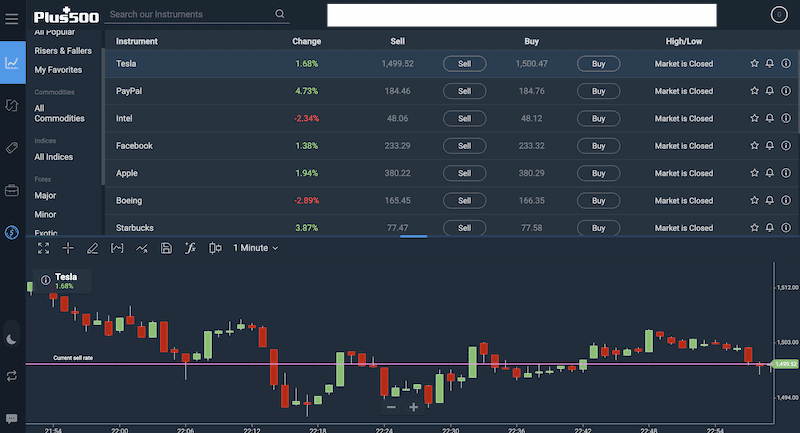

Choosing the right stockbroker is the first step to buy shares but it’s also important to do your own research before investing in a company, whether you’re considering investing in Fisher and Paykel or other NZ shares like Air New Zealand and Spark shares. This will ensure that you are familiar with the products and services the company provides, the share price historical performance, and the company’s financial status. For that reason, below you will find some of the reasons why you might consider buying Fisher and Paykel shares. Fisher and Paykel was launched in 1934 in New Zealand as an importer of refrigerators, washing machines, and radios but in the late 1960s, the company shifted its business model to healthcare. In 2001, Fisher and Paykel NZ was separated into two brands, Fisher & Paykel Healthcare Corporation Limited and a new company, Fisher & Paykel Appliances Holdings Limited (the two companies are no longer connected as Fisher & Paykel Appliances is now Chinese-owned). The company went public in the same year with listings on the New Zealand and Australian Stock Exchanges under the ticker symbol FPH. Since then, it has been an upward trajectory for the company’s shareholders. In fact, Fisher & Paykel Healthcare has recently become the first New Zealand company to be worth $20 billion. At the time of writing in July 2020, shares of Fisher and Paykel Healthcare are priced at NZD$35.55, which is the company’s all-time high so far. Ultimately, Fisher & Paykel Healthcare is the biggest company on the New Zealand stock market and one of the companies across the globe that were not affected by the COVID-19 in terms of revenues and the Fisher and Paykel share price. As a Fisher and Paykel Healthcare shareholder, you will be entitled to an interim and full dividend payment. Evidently, the company’s directors have approved a final dividend of 15.5 cents per share that was distributed to shareholders on 7 July 2020. This represents an increase of 15% on the final dividend payment in 2019 and brings the total dividend for the year to 27.5 cents per share, an increase of 18% from the previous year. According to the Australian Stock Exchange, the annual dividend yield stands at 0.79%, which is average for Medical Equipment stocks. With this in mind, below we have outlined the reasons why investors are currently bullish on Fisher and Paykel shares. Fisher and Paykel Healthcare saw massive demand due to the Covid-19 pandemic. Sales of its hospital hardware have doubled and tripled over the past few months. According to the company’s managing director Lewis Gradon: “we’ve been putting a lot more of that equipment in hospitals. Now they are used to it from Covid, they will start using it on other respiratory patients,”. The company posted a record profit amid the coronavirus pandemic and as the Covid-19 continues to spread across the world, it is likely that revenues will continue to increase. Fisher and Paykel is not just a company, it is a brand that has the largest market cap in New Zealand of more than NZD$20. F&P has 5,081 employees worldwide and its products and systems are sold in 120 countries around the world. It is therefore known as the ‘stock market darling’ of the New Zealand Stock Exchange. Fisher and Paykel NZ is also a constituent of the NZX 50 index that comprises the biggest stock in the NZ market by market capitalization. Over the past three years, F&P has seen its earnings per share grow by 19% per year. For the full year ended 31 March 2020, the company reported operating revenue of $1.26 billion, up 18% over last year. It also reported a net profit after tax of $287.3 million, up 37% from the previous year. The high increase in revenues can be largely accounted for by the high demand for products hospital hardware to treat COVID-19 patients. Looking ahead, with an extremely high price-to-earnings ratio of 74.3, the company’s future forecast is perhaps better than ever. It’s hard to see the share price falling sharply in the near future, particularly as the company’s services and products are vital for coronavirus patients. Once you have chosen a stockbroker that meets your requirements, you will need to open a trading account and deposit funds before you can make your first purchase. As such, we are now going to show you the steps you need to take in order to buy Fisher and Paykel shares from our recommended broker, Plus500. So, the first thing that you need to do is to visit Plus500’s homepage and open an account by clicking on the ‘Create Live Account’ button at the top right corner of the screen. The process is relatively straightforward – all you have to do is to enter your email address and password and create an account. Now that you are logged in, navigate to the Account section on the left menu of the trading dashboard, and then click on the ‘Verify Account’. To complete the registration process, you will need to provide your personal details such as your full name, contact details, country of residence, trading experience, and financial status. As an ASIC-regulated broker, Plus500 also requires you to provide documentation that verifies your identity. These include your: Once you’ve uploaded the above documents, you can deposit funds into your account. You will need to meet an NZD$200 minimum deposit, which you can do with a debit/credit card, PayPal, Skrill, or bank transfer. Now that you have funded your account at Plus500, you can then buy Fisher and Paykel Healthcare shares. On the trading platform, enter FPH or Fisher and Paykel NZ at the search bar at the top of the dashboard. Once you click on the Buy button, you will then see an order box. Now, all you need to do is enter the number of shares you want to buy and set a stop-loss order to sell the shares if the value of the security goes down (this is not a mandatory requirement). To complete your order, click on the Buy button on the order form. Note: If you are buying Fisher and Paykel share outside of standard market hours (9:00 am – 4:45 pm GMT+12), you will need to click on ‘Place Order’. Your Fisher and Paykel share purchase will then be completed when the markets open. Fisher and Paykel NZ is a high-quality company with a lot of room for growth. Its high profitability and capital expenditure make it one of the best shares to buy these days. As Fisher and Paykel consistently breaking new all-time highs amid the Covid-19 pandemic and growth is heading in a positive direction, it is only a question of how far the price may rise. If you do want to buy Fisher and Paykel shares, you can do so with low spreads on Plus500. Simply click the link below to get started today!

CFD Service. Your capital is at risk.

Fisher and Paykel Healthcare has a primary listing on the New Zealand Stock Exchange under the ticker symbol NZE: FPH and a secondary listing on the Australian Stock Exchange under the same ticker symbol. In addition, the company is traded on the OTC market under the symbol FSPKF.

This highly depends on the brokerage firm you choose. Traditional brokerage firms will charge around $5-$8 per side and an additional management fee. If using Plus500, you won't have to pay any share dealing charges at all. You will have to pay the buy and sell spread only.

Yes, Fisher and Paykel Healthcare does pay dividends. It pays dividends once a year, with an average annual yield of 0.79%.

If you decide to buy shares via CFDs, there's no minimum requirement as to how many shares you can buy. Plus500, for example, allows you to buy fractional shares as well as use leverage. This means that with an investment of NZD$200, you can make a purchase of NZ$1000 worth of Fisher and Paykel shares or around 33 shares.

Step 2: Research Fisher and Paykel Healthcare Shares

Fisher and Paykel Share Price History

Fisher and Paykel Healthcare Dividend Information

Should I Buy Fisher and Paykel Healthcare Shares?

Fisher and Paykel Healthcare has performed relatively well since the company went public in 2001. It is also suggested by analysts that the company’s revenues and earnings per share (EPS) are expected to grow in the near future. Nevertheless, you’ll have to make a good research before you invest in this company.

Fisher and Paykel Healthcare has performed relatively well since the company went public in 2001. It is also suggested by analysts that the company’s revenues and earnings per share (EPS) are expected to grow in the near future. Nevertheless, you’ll have to make a good research before you invest in this company.Massive Demand Amid the Covid-19 Pandemic

Most Valuable Company in New Zealand

Steady Growth & Profitability Ahead

Step 3: Open an Account and Deposit Funds

Step 4: Buy Fisher and Paykel Healthcare Shares

The Verdict

Plus500 – Buy Fisher and Paykel Healthcare Shares With No Commission

FAQs

Is Fisher and Paykel only traded on the New Zealand Stock Exchange?

How much does it cost to buy Fisher and Paykel shares in New Zealand?

Does Fisher and Paykel pay dividends?

What is the minimum number of Fisher and Paykel Healthcare shares that I can buy?