Best NZ Shares to Buy in 2021 Revealed

Capital.com: Buy the Best Shares with 0% Commission

Capital.com: Buy the Best Shares with 0% Commission

Capital.com: Buy the Best Shares with 0% Commission

As an investor from New Zealand, you will have access to both domestic and international shares at the click of a button. This means that there are tens of thousands of companies to choose from. While such extensive choice is always a good thing, this can also make it difficult to know which stocks to invest in.

In this article, we explore the best shares to buy in New Zealand. This includes a selection of home-grown companies, as well as stocks and shares listed overseas.

-

-

Top Shares to Buy in New Zealand 2021

Before we take a more detailed look at the best shares to buy, here’s a quick rundown of our top picks:

- British American Tobacco – Buy with 0% Commission Now

- BP – Buy with 0% Commission Now

- Amazon – Buy with 0% Commission Now

- Microsoft – Buy with 0% Commission Now

- Tesla – Buy with 0% Commission Now

- Spark NZ – Buy with 0% Commission Now

- Air NZ – Buy with 0% Commission Now

Best Shares to Buy for Dividends

So now that we have discussed the best NZ shares to buy in 2021, we now need to explore which stocks are suitable for dividend-seekers. In particular, this will ensure that you have a regular source of income – even if the respective stock price is not performing as expected.

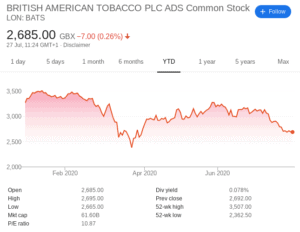

British American Tobacco (LSE)

British American Tobacco is one of the largest tobacco suppliers globally. The stock has its primary listing in London, albeit, it also has a presence in New York and Johannesburg. Nevertheless, BAT is still one of the best shares to buy for dividends at the moment. Its most recent dividend paid a trialing yield of well over 7% – and there is no reason to believe that this will be reduced any time soon.

Although the stocks are worth considerably less than they were pre-2017, British American Tobacco still has substantial free cash flows. We should also note that BAT is renowned for covering shortfalls in operating margins by simply increasing the price of its products.

This is because tobacco is classed as a ‘staple’ product, meaning that it will always be in demand irrespective of how the economy is performing. With this in mind, BAT could be a notable addition to your stock portfolio if you are looking to focus on dividend shares.

BP (LSE)

BP is yet another hallmark British institution that makes our list of the best shares to buy for dividends. In fact, its most recent distribution paid a trialing yield of over 10% – which is huge. Now, we must make it clear that there is no guarantee that the next dividend announcement will be as generous as this.

After all, the global oil markets came to a standstill in Q1/2 2020 as per the COV-19 pandemic. BP was hit especially hard, as its break-even price is somewhat high at $35 barrel. However, the good news for investors is that global oil prices have since stabilized above $40 per barrel.

For BP shareholders that are hoping for another double-digit dividend – things are looking promising. On top of its attractive dividend model, we should also note that BP represents an interesting investment for long-termers. This is because its shares are yet to recover from pre-COV-19 levels. As such, you stand the chance of buying BP shares at a major discount, making it one of the best shares to buy in NZ.

Best Shares to Buy for Beginners

If you are a complete novice in the world of stocks – then it’s best to focus on high-grade shares. By this, we mean companies that can be defined as strong and stable. This will ensure that you reduce the chances of picking shares that are overly susceptible to a wider stock market downfall. It will also allow you to avoid sleepless nights as to which direction the company in question is set to take in the coming years.

Amazon (NASDAQ)

It really doesn’t get much better than Amazon if you are looking for the best shares to buy for beginners. The company is now home to one of the most valuable stocks in the history of the US – and for good reason. In fact – and as you will see from the below graph, Amazon is one of the few stocks to have defied the wider financial markets.

By this, we mean that the firm has actually seen its stock increase this year. Not only have Amazon stocks increased in value since the turn of 2020, but they have done so by some distance. For example, a single Amazon share would have cost you $1,898 on January 2nd. Fast forward to July 27th and the same shares are worth $3,008.

This represents a 6-month increase of over 58%, which is uncanny. This gives Amazon a market capitalization of $1.5 trillion. There really is no-knowing just how big Amazon can get in the coming decades. After all, it’s not just online retail that the firm is involved in.

On the contrary, Amazon has a presence in everything from artificial intelligence, groceries, drone deliveries, and cloud computing. It has also expanded into the services sector – with Amazon Prime and Amazon TV leading the way.

Microsoft Corporation (NASDAQ)

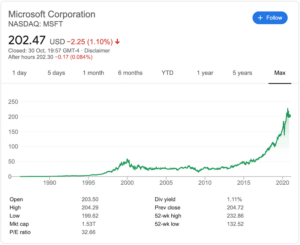

Microsoft is yet another strong and stable stock that is ideal for beginners. Make no mistake about it – Microsoft still dominates the consumer desktop and laptop scene. For example, Apple Mac – its nearest competitor, has a market share of just below 10%, Microsoft dominates at 88% (as of February 2020).

In terms of its stock performance, Microsoft is currently in “all-time high territory”. This means that its share have never been worth more. Once again, this is highly fundamental when you consider the wider impact of the COV-19 pandemic. At the start of the year, Microsoft shares were priced at $160.

The stocks took a slight hit in March – hitting lows of $135. However, Microsoft has been on an upward trajectory ever since. At the time of writing in late July 2020, the shares are priced at just over $200. This represents a year-to-date increase of 25%. It is also important to note that Microsoft has an extremely solid balance sheet.

This will set the firm in good stead if and when the stock markets start moving in the wrong direction. For example, it holds more than $130 billion in cash, cash equivalents, and short-term investments. At the other end of the spectrum, short and long-term debt levels stand at just over $63 billion. As a result, the firm is in a prime position to continue its strong and stable dividend policy.

Best Shares to Buy in NZ for Long-Term Growth

Every portfolio should contain a selection of shares for the future. By this, we mean companies that are still at the very start of their journey. In buying the stocks early, you will be well-positioned if the company in question makes it big in the future. With that said, you’ll want to go easy with your stakes when investing in up-and-coming stocks, as their business model is ultimately unproven.

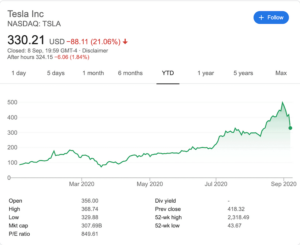

Tesla (NASDAQ)

Tesla is the world’s largest and most recognized electric car manufacturers. The company first went public in 2010, so it is not super-young. But, there is no doubt that Tesla is still in its infancy. After all, it is only just about turning a profit. Had you purchased its shares back in 2010, you would have paid just $17 per stock.

This valued Tesla at $226 million at the time of the IPO. As of late July 2020, the shares are now smashing through all-time highs. In fact, you will need to pay a per-stock price of $1,417 if you want to get a look in. This translates into a 10-year increase of over 8,200%. In terms of its 2020 performance, the stocks are up 229%.

This is staggering, especially when you consider that Tesla’s main production line was halted to a stop during the COV-19 lockdown. If you think you might have missed the boat – think again, as the potential of Tesla is virtually limitless.

Not only is the firm behind electric vehicles – but it is exploring other innovative sectors. This includes a major focus on renewable energy solutions for the consumer marketplace. Finally, rumours on Wall Street are pointing to a possible stock split in the very near future. As such, Tesla is one of the best shares to invest in for growth.

Best NZ Shares to Buy

If you are looking to keep things domestic, then you will need to buy shares in companies that are listed on the New Zealand Stock Exchange. Liquidity and trading volumes are much lower in comparison to the major markets of the US and UK, so do bear this in mind.

Spark New Zealand (NZX)

Spark New Zealand is one of the largest companies listed on the New Zealand Stock Exchange. As of late July 2020, it carries a market capitalization of just under $9 billion. The reason this particular stock makes our list is two-fold. First and foremost, Spark New Zealand is involved in products and services that many would argue are unaffected by the health of the wider economy.

For example, mobile networks, telecommunication, and internet services will always be in demand – even during times of economic uncertainties. Secondly, although Spark New Zealand encountered a drop in share value during Q2, the shares have since recovered nicely. For example, Spark New Zealand shares were priced at $4.39 at the turn of 2020.

They then hit lows of $3.74 in March. However, at the time of writing in late July, the shares are now priced at $4.88. This means that Spark New Zealand is one of the few domestic stocks to not only recover its COV-19 loses – but posses a higher share price. The final icing on the cake with Spark New Zealand is that it is currently paying a trialing dividend yield of 4.82%.

Air New Zealand (NZX)

You might be wondering why we would include an airline stock in our list of top picks. After all, the airline industry, in particular, was one of the hardest hit by the coronavirus pandemic. However, it must be questioned whether the sheer size of the decline is warranted in the case of Air New Zealand. At the turn of 2020, Air New Zealand shares were priced at $3.05.

Towards the end of March, those very same shares dropped to lows of $0.80 – which is incredible. In fact, this represents a near-on three-month decrease of 73%. This does make sense when you consider the wider travel ban implemented by the New Zealand government. But, the travel ban will not be in play indefinitely.

Moreover, the good news for investors is that Air New Zealand shares have shown signs of recovery since their 2020 lows. For example, the stocks hit $1.94 in June – which is more than double the $0.80 seen in March. Ultimately, if you believe that travel into and through New Zealand will eventually recover to pre-pandemic levels, you stand the chance of buying the shares at a significant discount, which is why we believe Air New Zealand is one of the best shares to buy right now.

How to Buy the Best Performing Shares NZ

Like the sound of one of the stocks we have discussed on this page – and want to buy shares right now? If so, we are going to show you what you need to do. There are tonnes of reputable online stock brokers that service New Zealand residents.

Best NZ Shares to Buy 2021 – The Verdict

In summary, there are tens of thousands of companies that you can buy shares in from the comfort of your home. To help illustrate which stocks are hot in New Zealand right now, we have presented a number of domestic and international shares for your consideration.

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane PepiLatest News

Music Streaming Revenues to Hit $23B in 2021, a 50% Jump Compared to pre-COVID-19 Figures

Like many other sectors, the music industry has been significantly affected by COVID-19, with the massive cancelation of live events and huge ticket sales revenue drops amid the lockdown. With earnings from live music events shrunk to the lowest level in history, artists increasingly rely on income from streaming platforms. According to data presented by...

Software Startups Raised $176.7B in Total Funding, a 27% Increase YoY

Software solutions have entered all aspects of life in the digital age, with millions of individuals and businesses relying on operating systems and apps to carry out daily tasks. The entire sector’s growth has been followed by the increasing number of software startups searching for a way to raise capital and expand their growth. According...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

BuyShares.co.uk © 2026.

All Rights Reserved. UK Company No. 11705811.

After all, the global oil markets came to a standstill in Q1/2 2020 as per the COV-19 pandemic. BP was hit especially hard, as its break-even price is somewhat high at $35 barrel. However, the good news for investors is that global oil prices have since stabilized above $40 per barrel.

After all, the global oil markets came to a standstill in Q1/2 2020 as per the COV-19 pandemic. BP was hit especially hard, as its break-even price is somewhat high at $35 barrel. However, the good news for investors is that global oil prices have since stabilized above $40 per barrel. By this, we mean that the firm has actually seen its stock increase this year. Not only have Amazon stocks increased in value since the turn of 2020, but they have done so by some distance. For example, a single Amazon share would have cost you $1,898 on January 2nd. Fast forward to July 27th and the same shares are worth $3,008.

By this, we mean that the firm has actually seen its stock increase this year. Not only have Amazon stocks increased in value since the turn of 2020, but they have done so by some distance. For example, a single Amazon share would have cost you $1,898 on January 2nd. Fast forward to July 27th and the same shares are worth $3,008. In terms of its stock performance, Microsoft is currently in “all-time high territory”. This means that its share have never been worth more. Once again, this is highly fundamental when you consider the wider impact of the COV-19 pandemic. At the start of the year, Microsoft shares were priced at $160.

In terms of its stock performance, Microsoft is currently in “all-time high territory”. This means that its share have never been worth more. Once again, this is highly fundamental when you consider the wider impact of the COV-19 pandemic. At the start of the year, Microsoft shares were priced at $160. This valued Tesla at $226 million at the time of the IPO. As of late July 2020, the shares are now smashing through all-time highs. In fact, you will need to pay a per-stock price of $1,417 if you want to get a look in. This translates into a 10-year increase of over 8,200%. In terms of its 2020 performance, the stocks are up 229%.

This valued Tesla at $226 million at the time of the IPO. As of late July 2020, the shares are now smashing through all-time highs. In fact, you will need to pay a per-stock price of $1,417 if you want to get a look in. This translates into a 10-year increase of over 8,200%. In terms of its 2020 performance, the stocks are up 229%.