How to Invest in Shares NZ

If you’re based in New Zealand and looking to start buying shares, the process couldn’t be simpler. All you need to do is open an account with a trusted New Zealand broker, deposit some funds with your debit/credit card or bank account, and then decide which shares you want to invest in.

But, if you’re yet to purchase shares from an online broker, you might be looking for a bit of assistance.

In this guide, we show you how to invest in shares in New Zealand in the easiest and cheapest way. We also discuss some of the best online brokers to do this with, alongside some handy tips on what you need to consider before getting started.

Step 1: Choose a New Zealand Share Broker

Put simply, if you want to learn how to invest in shares online, you will need to find a reliable share broker that meets your needs. There are many brokers active in the space that accept NZ residents, so you should have no issues in this sense. However, you still need to do some homework on a broker before signing up.

With this in mind, below we list some of the questions that you need to be asking of the provider.

- What shares does the broker allow you to invest in?

- Does the broker offer New Zealand shares, international shares, or a combination of the two?

- What is the minimum deposit amount required?

- What payment methods does the broker support?

- What fees and commissions does the broker charge?

- Is the broker regulated by a reputable licensing body like ASIC or the FCA?

Performing independent research on a magnitude of brokers can be extremely time-consuming. As such, if you’re keen to get started with a share investment now, below you will find a list of reputable New Zealand share brokers.

Note: All trading fees and minimum deposit amounts listed below are denominated in US dollars.

1. Plus500 – CFD Trading Platform with Tight Spreads

Although not technically ‘investing’ in shares, this particular option is suitable for those of you that wish to ‘trade’. Put simply, Plus500 is an online trading platform that allows you to trade CFDs. This includes CFDs in the form of stocks, indices, commodities, interest rates, cryptocurrencies, and more. In the stock CFD department alone you will find over 2,000 financial instruments.

This covers heaps of international markets, such as the UK, US, Portugal, Japan, Greece, Norway, and Switzerland. Best of all, you can also trade several New Zealand stocks. This includes the likes of Spark, Fletcher Building, and Fisher and Paykel. Irrespective of which stock CFDs you decide to trade at Plus500, you will never pay any trading commissions.

Spreads are tight, too – so you will benefit from a hugely competitive all-around pricing structure. This is also the case for deposits and withdrawals – which are fee-free. When it comes to funding your account, you can this with a New Zealand debit/credit card, bank account, or Paypal. In terms of licensing, Plus500 is licensed by ASIC in Australia, FMA in New Zealand, in addition to the FCA in the UK.

Pros:

- Commission-free CFD provider – only pay the spread

- Thousands of financial instruments across heaps of markets

- Ability to trade stock CFDs with leverage of 1:5

- You can short-sell a company if you think its value will go down

- Takes just minutes to open an account and deposit funds

Cons:

- CFDs only

- More suitable for experienced traders

CFD Service. Your capital is at risk.

3. IG – Trusted NZ Share Investment Platform With MT4

IG is a major player in the online share investment scene, with over 178,000 traders using the platform. Launched way back in 1974, the broker has an excellent reputation for providing top-grade share dealing services. Its reputation is amplified by its strong regulatory standing – which includes licenses with ASIC, the FCA, and others.

In terms of its share dealing offering, IG lists over 13,000 stocks with many of the best shares to invest in. This covers dozens of international markets, as well as a good selection of New Zealand-based companies such as Air NZ. As a New Zealand resident, you will not pay any share dealing fees at IG unless you are looking to invest in Australian stocks.

IG is also useful if you decide to trade shares. This is because it offers thousands of stock CFDs – all of which you can apply leverage. This means that you can trade with more money than you have in your account. For example, a $100 trade at IG with leverage of 1:10 would permit an order value of $1,000. If trading is what you are after, MT4 is supported.

Pros:

- Trusted NZ broker with a long-standing reputation

- Good value share dealing services

- Leverage and short-selling also available

- Spread betting and CFD products

- Access to over 13,000 stocks

- Great research department

Cons:

- A minimum deposit of £250 (about $490 NZD)

- US stocks have a $15 minimum commission

Step 2: Learn How to Invest in Shares in NZ

Once you have found a New Zealand stock broker that is able to facilitate your long-term investing goals, you then need to ensure that you have a firm grasp of how the share markets work. This is crucial, as you are going to be depositing real-world dollars in into your brokerage account, and of course – taking risks.

With this mind in mind, we would suggest reading through the explainers outlined below.

What Does it Mean to Invest in Shares?

Stocks are listed on public exchanges, which allows people to buy and sell the shares at the click of a button. This includes the likes of the London Stock Exchange, NASDAQ, New York Stock Exchange, and of course – the New Zealand Stock Exchange.

Once you buy a share, this affords you a number of rights. For example, if the company in question pays dividends, then you will be entitled to your share. Similarly, shareholders have the right to vote in Annual General Meetings (AGMs).

How Does a Shares Investment Work?

The share investment process is actually very straightforward. In fact, the end-to-end process can often be completed in minutes, meaning that you can start building your share portfolio with immediate effect.

Let’s look at a quick example to illustrate how a share investment works in New Zealand.

- You open an account with a regulated NZ stock broker

- You deposit $1,000 with your debit card

- You buy $400 worth of shares in Air New Zealand

- You leave the remaining $600 in your brokerage account for a later date

- A few years later, you decide to sell your Air New Zealand shares when they are worth $700

As you can see from the above, once you invest in shares at an online broker, you don’t need to do anything else. That is to say, the shares will remain at the broker until you decide to cash them out. When you do, the funds will be reflected in your cash account, which can then be reinvested or withdrawn.

Why Invest in Shares? Making Money From a Share Investment

As noted above, people invest in shares to make money. But how is this achieved? Well, shares allow you to grow your investment in two key ways – capital gains and dividends.

Let us elaborate on how each share investment stream works.

Capital Gains

In a nutshell, when you sell your shares at a higher price than you originally paid, the profits are known as capital gains. Although there are no guarantees that your share investment will benefit from capital gains, over the course of time the wider stock markets have always grown.

Nevertheless, here’s an example of a successful investment that resulted in healthy capital gains:

- You invest $2,000 into Apple shares

- At the time of the investment, Apple shares are worth $200 per stock

- 7 years later, Apple shares are worth $800 per stock

- This represents an increase of 300%

- As such, you decide to sell your Apple shares at a total value of $8,000

- You originally paid $2,000 for the shares, meaning that your capital gains are $6,000

As is the case with most investment streams in New Zealand, you will likely need to pay tax on any capital gains that you make. This is usually realized once the shares have been sold.

Dividends

Most, but not all, major companies pay dividends. This allows the firm to share some of its excess profits with stockholders. The company in question will likely do this every 3 months, albeit, some payout bi-annually.

Dividends are great for your long-term investing goals, as you can re-invest them into other assets as and when they are paid. In doing so, you stand the chance to grow your money much faster. This is because of the effects of compound interest – which allows you to earn ‘interest on the interest’.

Nevertheless, let’s look at how dividends work on a share investment in New Zealand.

- Let’s suppose that you hold 100 shares in Johnson & Johnson

- The firm announces that in Q3 2020 it will be distributing a dividend payment of $7.35

- You hold 100 shares, so this means that you receive $735 in dividend payments

- When the payment is released, it will be transferred to the stock broker account that you are holding the shares in

As noted above, shrewd investors will then re-invest these dividend payments as soon as they arrive. Much like the profits you make via capital gains, New Zealand residents are typically required to pay tax on dividend payments.

Understand How Much it Costs to Invest in Shares

An additional factor that you need to take into account before investing in shares is the costs involved. As you might have guessed, online share dealing platforms are in the business of making money. As such, each investment will attract a fee – which will vary depending on the broker.

This includes:

The Spread

When you visit your chosen online broker, you will notice that you always see two different prices attached to a share investment. One price is known as the ‘bid price’, and the other the ‘ask price’.

In simple terms:

- The ‘bid’ price is how much a buyer is willing to pay for the shares.

- The ‘ask’ price is how much the holder wants to sell them for.

- The difference between these two prices is the ‘spread’.

So why does this matter? Well, New Zealand brokers make money from the spread, as it ensures they make a profit regardless of which way the markets go.

As such, the wider the gap between the bid and ask prices, the more you are indirectly paying in fees. If, for example, the spread amounted to 1%, this means that you would need to make at least 1% in gains just to break even!

Commissions/Share Dealing Charges

Trading commissions – otherwise referred to as share dealing charges, is the fee that you pay to place an order. Every share investment will consist of two orders. One when you buy the shares (buy order), and the other when you sell them (sell order). As such, you effectively pay the charge twice.

Flat Fee: Some stock trading platforms in New Zealand will charge a flat trading fee, which is great for those of you that wish to invest larger amounts. For example, if the broker charges $10 per trade, it doesn’t matter if you invest $100, $500, or $20,000 – you will always pay $10.

Variable Fee: In other cases, some New Zealand stock brokers will charge a variable commission. This is a percentage fee based on the amount you invest, so it generally favours smaller stakes. For example, if the broker charges 0.5% and you invest just $100, then your fee will amount to $0.50.

With that being said, top-rated platforms like Plus500 allow you to invest in shares on a commission-free basis. Other than the spread, there are no flat fees or variable fees to take into account!

Step 3: Choose a Share Investment Strategy

So now that you know the basics of what it takes to invest in stocks and shares, we now need to talk strategy. In other words, you need to think about the methods you are going to take to identify viable share investments. After all, there are tens of thousands of companies to invest in across dozens of domestic and international stock markets.

In this sense, we would suggest considering one of three options – which we elaborate on below.

DIY (Do-It-Yourself) Share Investing

As the name suggests, investing on a DIY basis means that you will be choosing your own investments. That is to say, you will need to carefully research which shares to buy based on a range of variables. This will include everything from whether or not the firm pays dividends, what its long-term growth potential looks like, and how strong its balance sheet it.

There are many methods that you can utilize to help pick the best shares for your long-term investing goals, such as:

- Fundamental Research: Reading, analysing, and evaluating news stories is known as fundamental research. For example, let’s suppose that British American Tobacco forms an agreement with the Chinese government that permits the firm to sell its products in the country. This would impact the share price of the company in a positive manner.

- Earnings Reports: Public companies are legally required to release an earnings report every three months. The findings will be published in the public domain – so everyone is on an equal playing field. Put simply, this allows you to assess how well the company is performing. The report will include everything from revenues, operating margins, growth, assets, liabilities, and more.

- Financial Ratios: Seasoned investors like Warren Buffet will focus on key financial ratios. The idea here is to find companies that represent a good long-term investment. In particular, financial ratios allow you to focus on companies that could be undervalued. At the forefront of this are ratios like the price-to-earning and debt-to-equity ratios.

Ultimately, when you invest on a DIY basis, you take full responsibility for the shares that you add to your portfolio. You are also in charge of market timing, meaning that you decide when you enter and exit a position.

ETF or Mutual Funds

If you are nervous or intimidated by the thoughts of having to choose which shares to invest in, it might be worth considering an ETF or mutual fund. Both share investment streams operate largely in the same manner, insofar that the provider will buy and sell stocks on your behalf. In the case of ETFs, the provider will typically track a specific marketplace.

- For example, an ETF might track the Dow Jones 30 – meaning that it will buy shares in all 30 constituents.

- Similarly, an ETF might focus on FTSE 100 stocks, meaning that its portfolio will contain all 100 firms that make up the index.

In the case of a mutual fund, the provider has a bit more flexibility. This is because rather than simply tracking a market, it will make informed decisions as to which shares to buy and sell – and when.

Nevertheless, as both ETFs and mutual funds are 100% passive, this removes the need for you to choose investments yourself. On the contrary, once you make an investment, the provider takes care of the rest. This is ideal if you have little to no experience of how to invest in shares, or you simply don’t have the time.

Step 4: Invest in Shares NZ

If you have read our guide up to this point, you should now be armed with the required tools to enter the stock market for the very first time. If so, we are now going to walk you through the process of how to invest in shares in New Zealand. To ensure that you understand the steps we have taken, the guidelines listed below are based on popular broker Plus500.

Open an Account and Verify Identity

No matter which New Zealand stock broker you decide to buy shares through, you will always need to open an account. This is so the broker knows who you are and that it complies with its respective license issues (FCA, ASIC, etc.). As such, head over to the Plus500 website and elect o to open an account.

You will need to provide the following:

- Full name

- Nationality

- Home address

- Date of birth

- New Zealand tax number

- Contact details

You will also need to answer a few basic questions about your historical share investment experience.

Next, you will need to bypass a quick KYC (Know Your Customer) process. Once again, this is to ensure that Plus500 complies with its licensing issuers. All you need to do is upload a copy of your NZ passport/driver’s license and a proof of address. This can be a utility bill or bank account – as long as it was issued within the past three months.

Deposit Funds

Once you have uploaded the aforementioned documents, Plus500 will ask you to deposit some funds. You can choose from a New Zealand debit/credit card, bank account, or e-wallet. Regarding the latter, this includes Paypal, Skrill, and Neteller.

A few points to note about deposits at Plus500:

- Minimum deposits start at $28 – which is about $28 NZD.

- All deposits come with a 0.5% conversion fee. This is because your Plus500 account will be denominated in US dollars.

- All deposit methods are instantly credited – apart from a New Zealand bank account (1-5 working days).

Once your account has been funded, you are then ready to invest in shares!

Invest in Shares

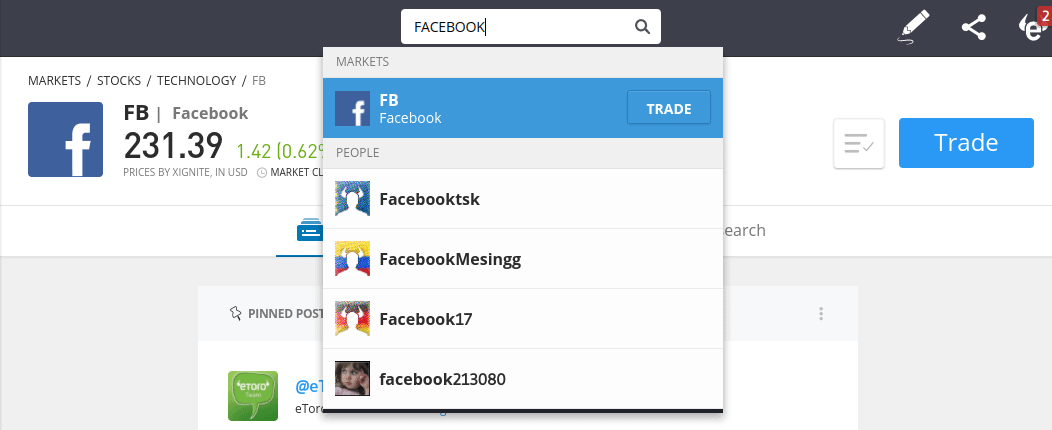

Plus500 is home thousands of shares across many international markets. As such, it’s best to use the search function at the top of the page. In our example, we are going to buy shares in Facebook – as per the screenshot below.

Upon clicking the result that pops up from the search box, we then need to click on the blue ‘Trade’ button.

In doing so, you will be presented with an order box. As you are simply looking to invest in shares, all you need to do is enter the amount that you wish to stake (in USD). For example, if you want to buy $500 worth of shares on Facebook, enter this into the ‘amount’ box.

Once you confirm the order, you are then officially a stockholder of your chosen company!

Invest in Shares NZ – The Verdict

As a New Zealand resident, investing in shares has never been easier. This means that you can now buy shares in a matter of minutes. You simply need to open a brokerage account, fund it, and then decide which shares to invest in.

With that said, it would be unwise to enter into the online stock market scene without first having a basic understanding of how things work. This is why we have discussed some of the things that you need to consider before taking the plunge.

If you’re ready to invest in shares right now, Plus500 allows you to open an account at the click of a button. By instantly depositing funds with an NZ debit/credit card or e-wallet, you can then invest in shares without paying any commissions!

Plus500 – Invest in Shares with Low Commission

Disclaimer: Investing in shares involves a significant risk of loss and is not suitable for all investors. You should carefully consider your investment objectives, level of experience, and risk appetite before making a decision to buy shares. Most importantly, do not invest money you cannot afford to lose.

FAQs

What shares can New Zealand residents invest in?

The stock markets that you are able to access will ultimately depend on your chosen broker. For example, Plus500 offers over 2,400 shares across many different markets. IG takes things to a whole new level as it offers more than 13,000 different shares!

What does it mean to 'invest' in shares?

By investing in shares, you are buying a small stake in your chosen company. As a shareholder, you will then be entitled to dividends and the ability to vote in AGMs.

What is share trading?

Share trading means that you are speculating on the short-term value of your chosen stock. This means that you need to decide whether you think the shares will go up or down in value.

How do I receive dividends in New Zealand?

When dividends are distributed by companies, they will be sent to the stock broker that you hold the shares with. You can then withdraw the cash out to bank account, or reinvest the funds into other shares.

How much do I need to invest in shares?

Once again, account minimums are determined by the respective broker.